Two-Tier Security Architecture

Two-Tier Security Architecture That Gives Banks Total Control

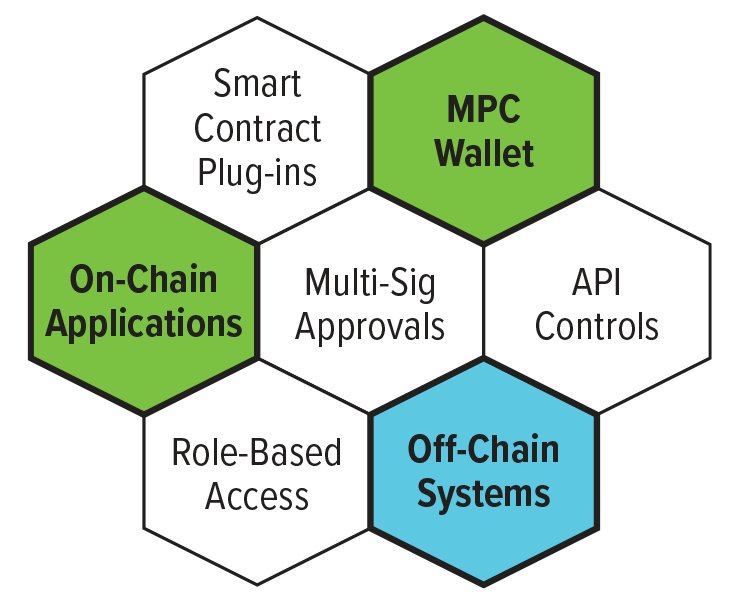

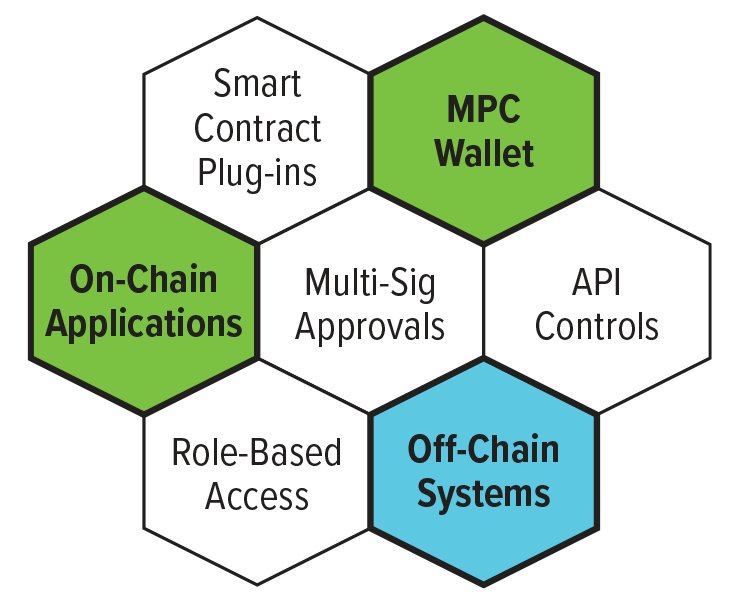

Vici Network delivers a proprietary two-tier security and control system for financial institutions issuing private payment stablecoins. The first tier, Vici Network’s Modular Smart Contract Framework, defines and enforces stablecoin policies through a series of plug-ins at the blockchain layer, which exacts compliance by all wallets and applications. The second tier, our Multi-Party Computing (MPC) Wallet, synthesizes the smart contract with off-chain banking systems to further validate critical transactions. Only together can banks achieve the scalability, security and control to manage their own stablecoin.

Modular On-Chain Security & Compliance Framework

Vici Network’s modular framework uses a plugin architecture that lets administrators compose and implement application-agnostic stablecoin policies as broadly or as surgically as needed, regardless of which wallet or application initiates the transaction. Each on-chain transaction passes through a configurable pipeline of plugins that validate, transform, or prevent activity based on policy. This architecture provides the agility to add, remove, or upgrade plugins without redeploying the core token contract, enabling banks to adapt to emerging threats and new regulations without system overhauls.

Vici Network’s MPC Wallet

The Vici Network MPC Wallet serves as an application-level validation layer that bridges blockchain functionality with existing banking infrastructure. Through secure APIs, the wallet interacts with off-chain applications and validates transactions against off-chain data sources before submitting to the blockchain. The wallet offers role-based access controls to grant and revoke permissions for specific wallet functions, which includes access to approve multi-signature transactions for smart contract operations.

Two Tiers Working Together

The two-tier system operates through coordinated validation at both layers. When initiating a critical operation that requires both on-chain and off-chain data sources, the MPC Wallet first validates the transaction against off-chain data and internal bank policies. Once approved at the application level, the wallet submits the transaction to the blockchain where the smart contract’s plugin pipeline performs its own validation. During on-chain validation, contract plugins verify that the wallet possesses the required roles and that all blockchain-level policies are satisfied. For example, when minting stablecoins, the wallet might check treasury balances and operational thresholds before submission, while the contract plugins verify role permissions and on-chain compliance rules. Only when both tiers approve does the transaction complete, creating a unique approach that combines off-chain flexibility with on-chain enforcement guarantees.